Section 127 3 B Income Tax Act 1967

Income tax act 1967.

Section 127 3 b income tax act 1967. Relief from income tax act. Section 127 under a non application provision covers exemptions granted under the following sub sections. Charge of income tax 3 a.

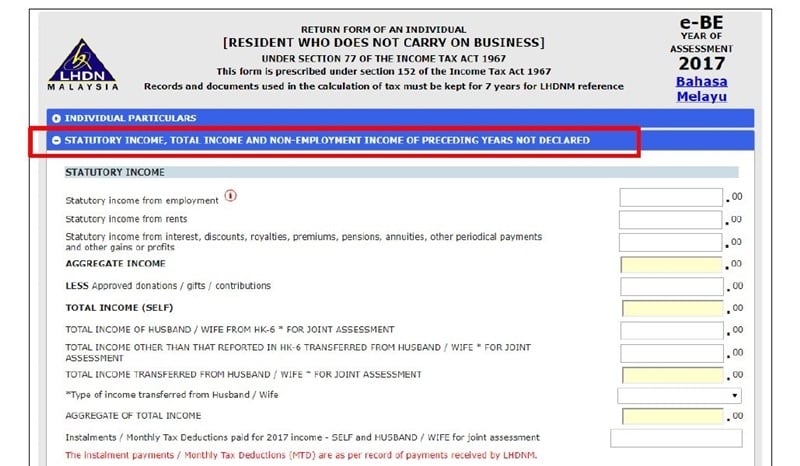

Business income income arising from services rendered by an ohq company to its offices or related companies. The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. This is because the exemptions under the abovementioned sub sections are.

Review of the income tax act 1967 under the self assessment system of taxation page 2 of 40 area of review findings recommendations compared to penalty under section 77b 4 which is based on the additional tax payable. Short title and commencement 2. There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976.

Interpretation part ii imposition and general characteristics of the tax 3. Notwithstanding any other provision of this section when stating on a tax deduction card an amount in respect of allowances deductions and reliefs. Interest income derived from interest on foreign currency loans extended by an ohq company to its offices or related companies.

This act shall unless otherwise expressly provided for in this act be construed as one with the income tax act cap. Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. Economic expansion incentives 2005 ed.

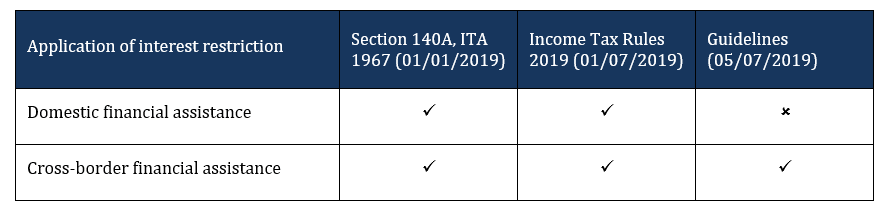

Section 127 3a for tier 2 3 via an approval from the ministry of finance. Years under section 127 income tax act 1967 for income derived from the following sources. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.

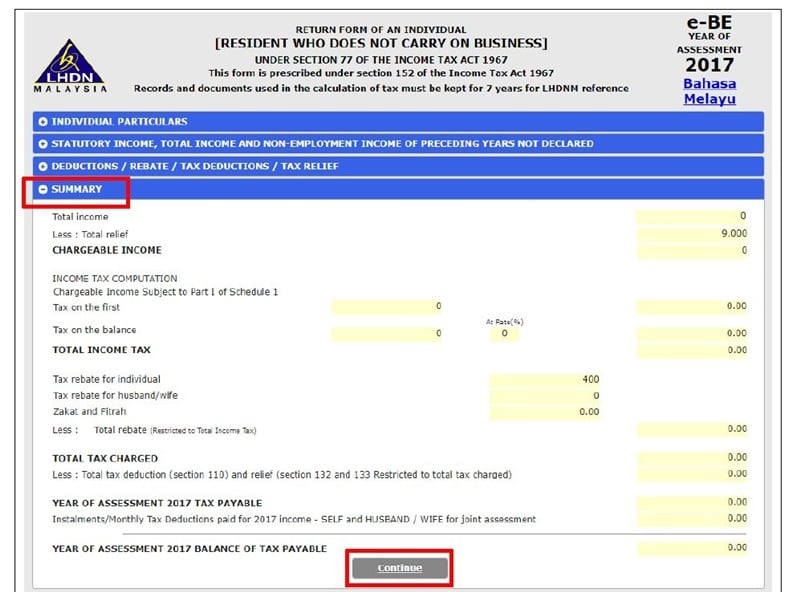

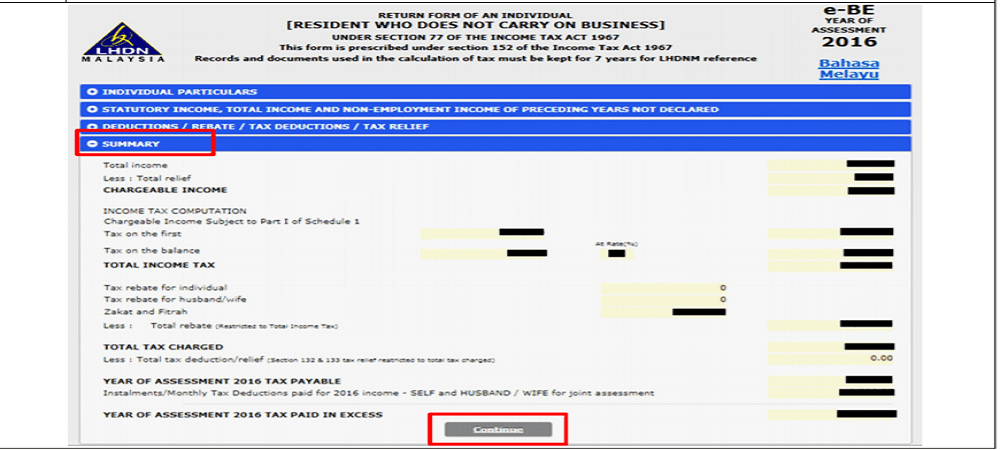

4 3 wilful evasion sections section 114 1 offence 114 1 and. Instead of the tax undercharged to be in line with section 77b 4. The tax exemption will be provided under the following sections of the income tax act 1967.

Act to be construed as one with income tax act 2. Non chargeability to tax in respect of offshore business activity 3 c. 3 laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1.

Section 127 3 b for tier 1 and value added income incentives via a gazette order. Akta cukai pendapatan 1967 is a malaysian law establishing the imposition of income tax. Relief from income tax cap 86 6 informal consolidation version in force from 15 6 2020.