Sales Tax Exemption Malaysia

How to check sst registration status for a business in malaysia.

Sales tax exemption malaysia. Disposed by him and on taxable goods imported into malaysia. Persons exempted under sales tax persons exempted from payment of tax order 2018. Such exemption is granted in the sales tax exemption from licensing order 1972.

Malaysia sales tax 2018. The move was made back then in anticipation of the re implementation of the sales and services tax sst. Sales tax exemption expansion october 6 2020 the sales tax persons exempted from payment of tax amendment no 2 order 2020 was published in the official gazette on 5 october 2020 and is effective 6 october 2020.

Qualification to obtain the sales tax exemption facility. Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. The schedule a of the sales tax exemption from licensing order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding rm100 000 are exempted from the requirement of applying for a sales tax licence.

Exemption from the sales tax under clause 99 table b sales tax order exemption 1980 is a facility provided for the benefit of local factory operators that manufactures goods that are exempted from the sales tax which are meant for export and also on control items under the ration control act 1961 which is bound under the price control to get taxed raw materials including packaging material excluding the sales tax. Sales tax exemptions. Exemption of tax on the acquisition of raw materials components packaging to be used in manufacturing of taxable foods sources.

However sales tax is not charged on goods and manufacturing activities exempted by minister of finance under sales tax goods exempted from tax order 2018 and sales tax. Import duty and sales tax exemption on equipment and machineries for port operators value added activities carried out in licensed manufacturing warehouse lmw and free industrial zone fiz review on condition for purchase of duty free goods for persons entering malaysia economic stimulus package esp 2020. Scope charge sales tax is not charged on.

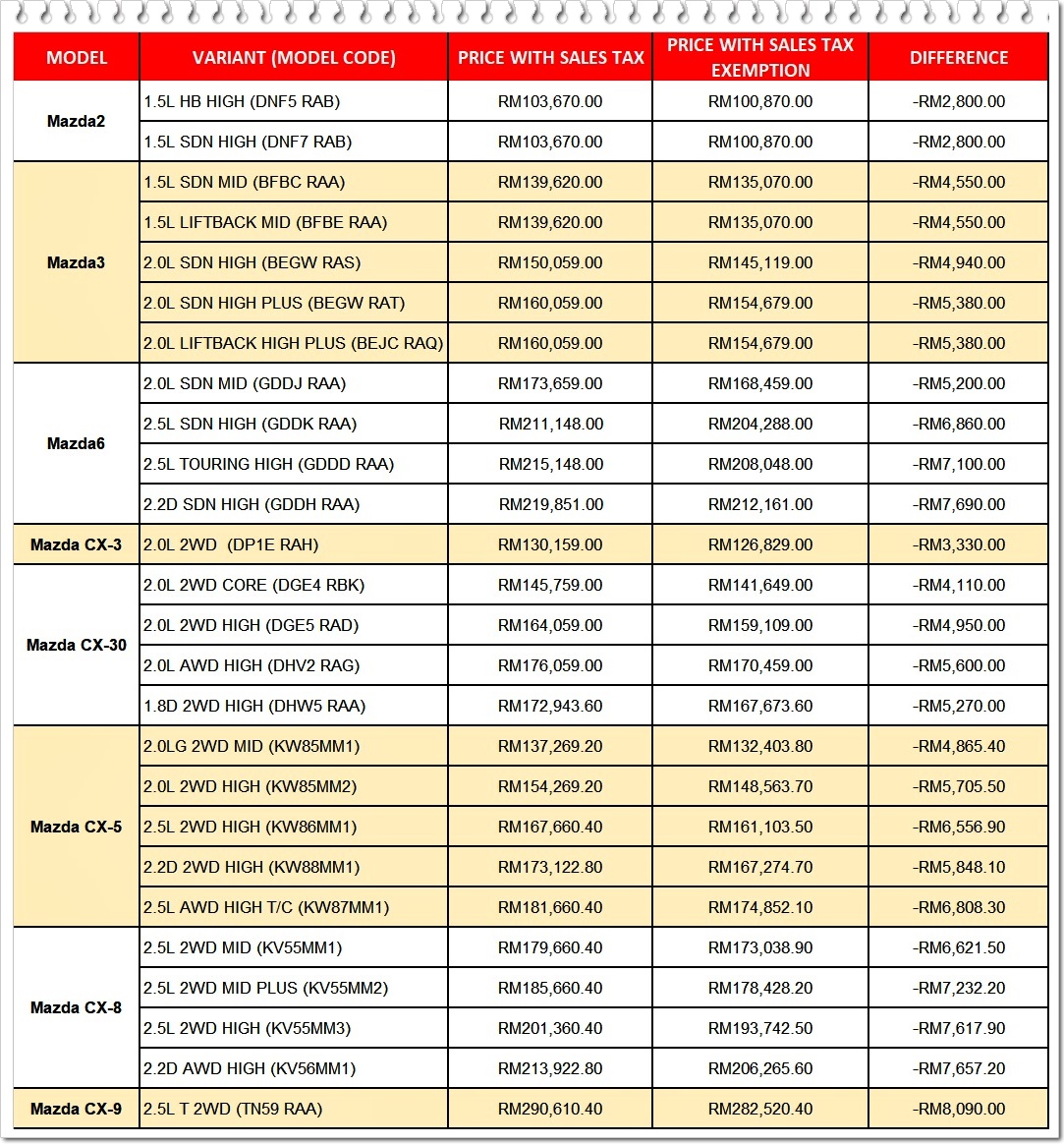

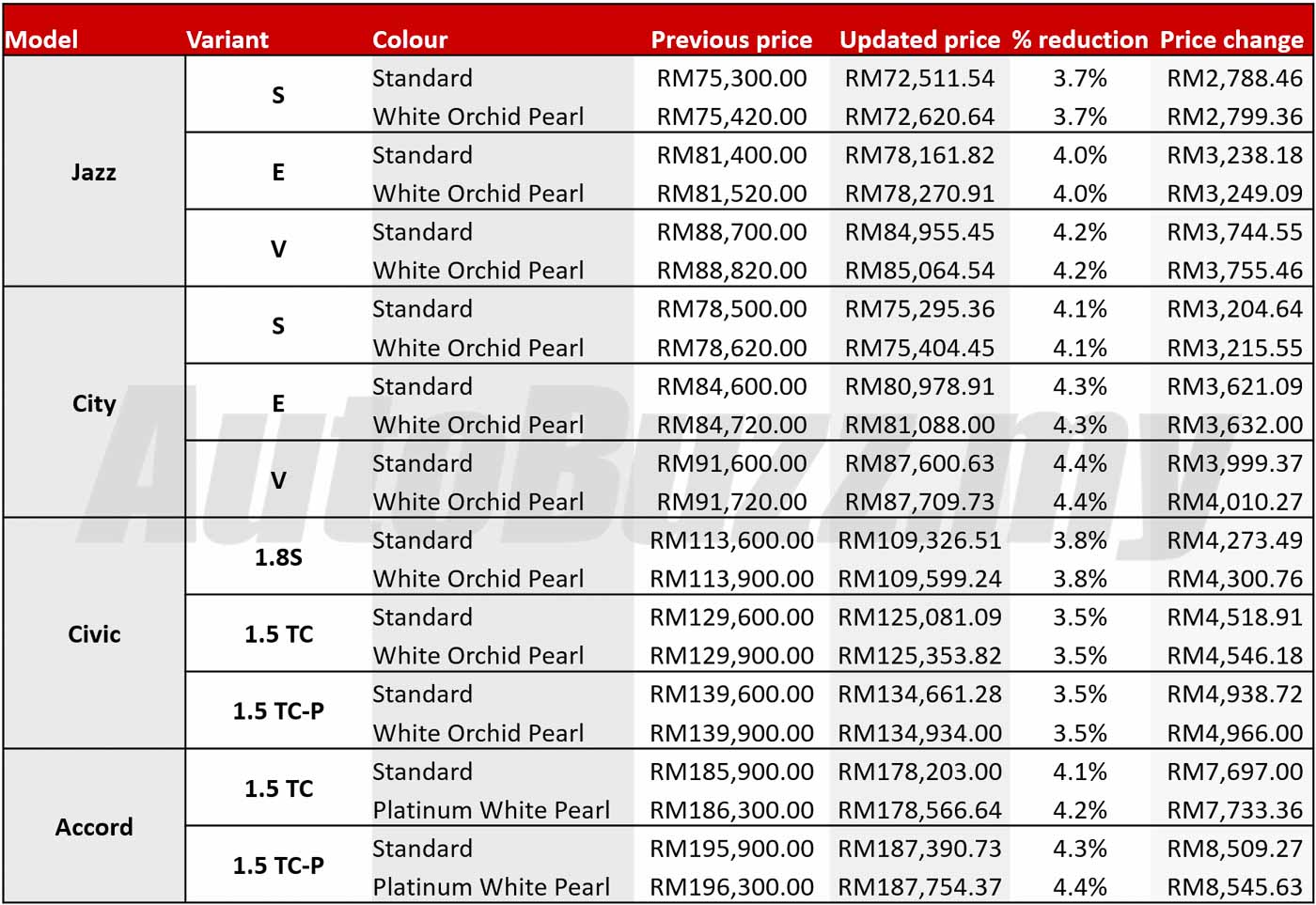

A tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in malaysia by a registered manufacturer and sold used or disposed of by him. The sales tax exemption is fundamentally similar to the tax holiday that malaysians enjoyed between june to august 2018 during which the goods and service tax gst was zero rated from all vehicle prices. According to the malaysian automotive association maa pick up trucks will not enjoy any sales tax exemption because they are classified as commercial vehicles as it turns.

Or b imported into malaysia by any person.