Salary Calculator Malaysia 2018

In kuala lumpur kl accounting and finance cfos can expect to earn an annual salary of rm420k rm720k.

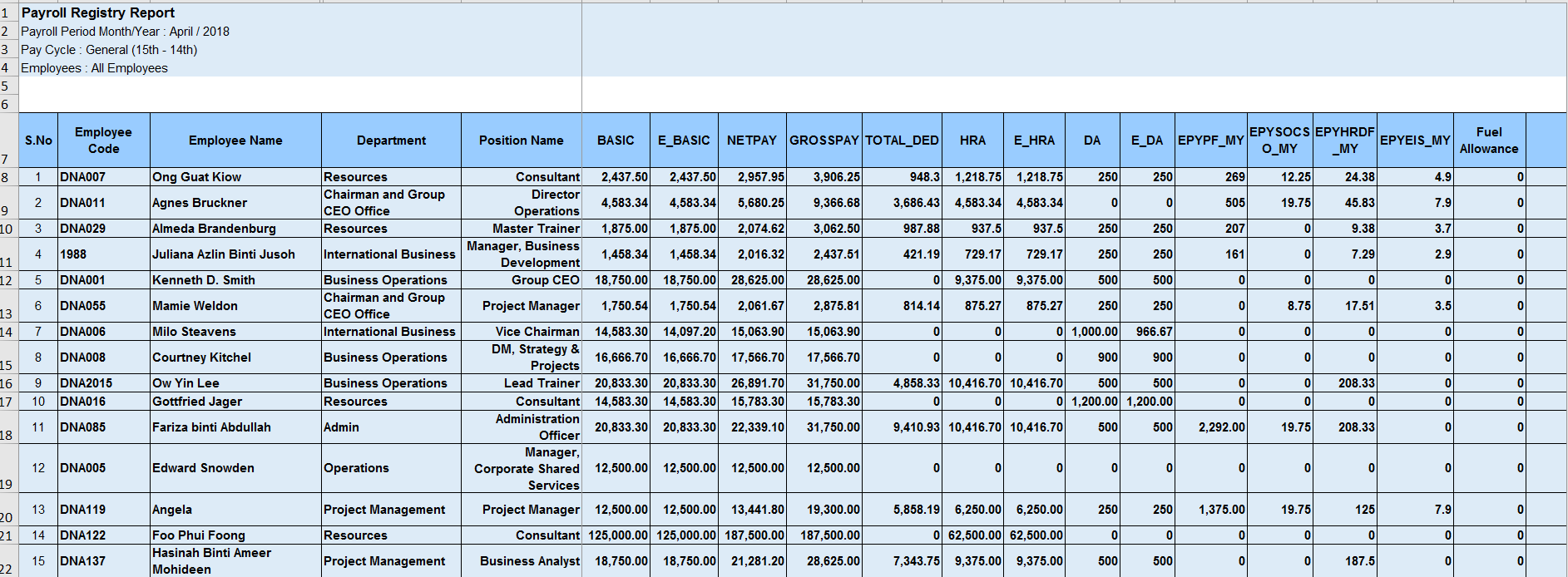

Salary calculator malaysia 2018. Finish your monthly payroll in minutes with 3 simple steps. This simple pcb calculator is created by jeremi song. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. With a separate assessment both husband. Meanwhile finance directors can expect an annual salary of rm300k rm456k for mncs and rm240k rm300k for smes.

Actpay is written for malaysian small businesses. Monthly tax deduction pcb and payroll calculator tips calculator based on malaysian income tax rates for 2019. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Easy to use malaysia salary calculator payroll functions and procedures. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. The nominal gross national income gni per capita is expected to rise 5 1 to rm42 777 in 2018 from rm40 713 in 2017 with investment growth to outpace savings.

The salaries provided are for use in the salary comparison tool only and does not included bonuses or benefits. All married couples have the option of filing individually or jointly. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes.

Calculation source referred from inland revenue board of malaysia. If any doubt always refer to official pcb schedule 2018 or consult your tax consultant. On that note salary increases of 15 20 expected to remain the norm in 2018.

Tax consultation is not available at the moment. Actpay s simplified payroll calculator functions makes monthly payroll calculations fast and easy. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available.

Your average tax rate is 15 12 and your marginal tax rate is 22 50. The savings investment gap is seen narrowing to 2 3 of gni. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582.

Under the minimum wages order amendment 2018 effective 1st january 2019 the minimum wages is rm1 100 per month should be paid to an employee who is paid monthly and rm5 29 per hour for an employee who is paid hourly including sabah and sarawak.