Rpgt Malaysia 2017 Rate

As mentioned earlier the government has tinkered around with rpgt rates a few times over the last decade or so largely in an effort to curb speculation and property flipping.

Rpgt malaysia 2017 rate. Real property gains tax rpgt rates. As such rpgt is only applicable to a seller. Disposal date and acquisition.

Malaysia budget 2017 is looming up and there are already signs in the market that significant changes are coming along. Tax payable net chargeble gain x rpgt rate based on holding period rm171 000 x 5 rm8 550. Rm 63 000 rm 1 400 rm 9 000 rm 4 400 rm 48 200.

Assessment year 2016 2017. You ll pay the rptg over the net chargeable gain. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

Which is why we ve included a full list of income tax relief 2017 malaysia here for your calculation. Pesanan lhdnm menjelang tahun 2018 berita harian 29 december 2017. Real property gains tax rpgt in malaysia.

Among the exemptions are. Of course these exemptions mentioned in the example are not the only one. Rpgt rates in 2016 and 2017.

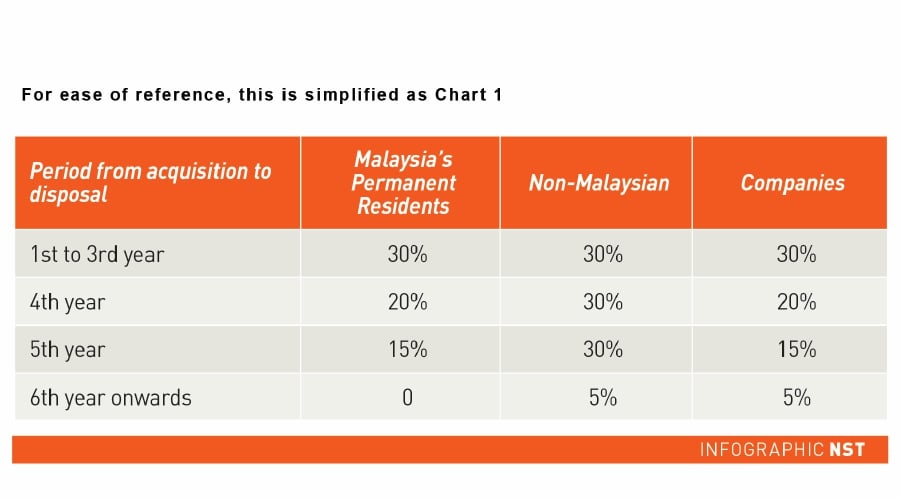

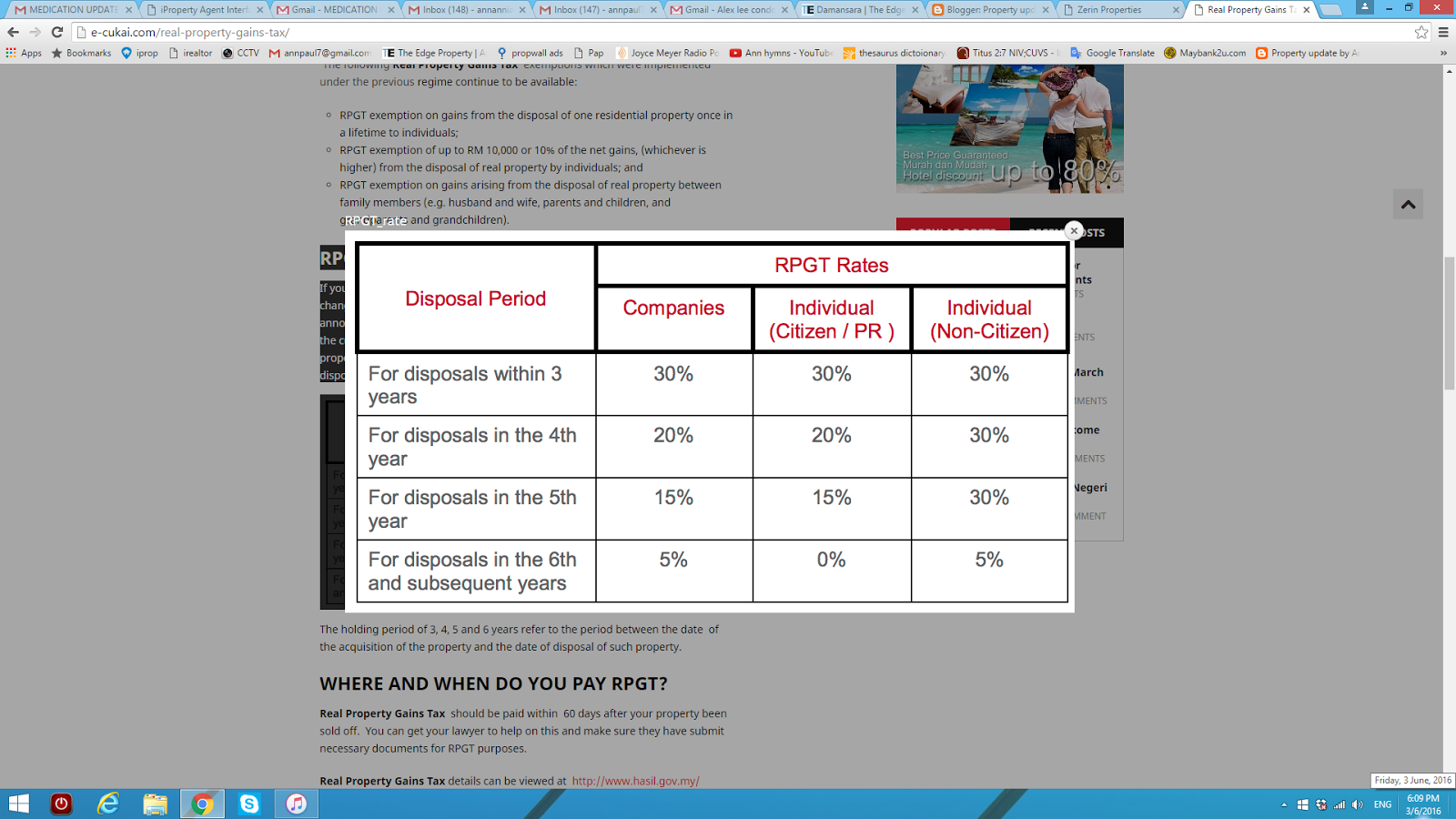

In the announcement of budget 2014 every property owners have to pay rpgt at a 30 for properties sold within 3 years or less 20 for properties disposed within 4 years and 15 for properties disposed in 5 years. Rpgt rm 250 000 x rpgt rate the rpgt rate that applies depends on a number of factors which i ll elaborate on below. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

If you owned the property for 12 years so you ll need to pay rpgt of 5. Real property gains tax scope rpgt rates returns and assessment date of disposal withholding by acquirer payment by disposer exemptions stamp duty basis of taxation rates of duty stamping penalty relief exemption remission from stamp duty goods and services tax effective date and rate of tax scope of taxation taxable person and registration. Calculations rm rate tax rm 0 5 000.

The statutory reserve requirement srr ratio was reduced from 4 to 3 5 in january 2016 epf contributors were given the option to reduce their compulsory contributions from 12 to 8 in february 2016 and the overnight policy rate opr was reduced by 0 25 in july 2016. On the first 2 500. Real property gains tax rpgt is a tax chargeable on the profit gained from the disposal of a property and is payable to the inland revenue board.

The rpgt would then be calculated by taking the chargeable gain and multiplying it by the rpgt rate. Real property gains tax rpgt rates. Above rpgt rates in malaysia as of budget 2014.

Disposal date and acquisition. There are some exemptions allowed for rpgt. It includes both residential and commercial properties estates and an empty plot of lands.